Research Conducted By: Jack Macnamara, Alfonso Vaca-Loyola, Samuel George, Amber Hendley, Jasson Perez, Michelle Delgado, Maria Starck, Moses Timlin, Lena Townsell and Nick Zettel

Data Analysis Conducted By: Alfonso Vaca-Loyola and Jack Macnamara under the guidance of William “Sandy” Darity, Ph.D.

Project Directors: Bruce Orenstein, Janet Smith, and Jack Macnamara

Report Written By: Sharon McCloskey and Bruce Orenstein

Executive Summary: “The Plunder of Black Wealth in Chicago: New Findings on the Lasting Toll of Predatory Housing Contracts,” set out to calculate the amount of money extracted from Chicago’s black communities in the 1950s and 60s through the practice of what was commonly referred to as home contract sales (also referred to as home installment contracts, contract for deed, or land sale contracts). This common but little-known practice took root in the period of the housing boom that followed World War II, and grew out of federally endorsed redlining policies that denied most black homebuyers access to the conventional mortgage loans enjoyed by their white counterparts. Home sale contracts were the creation of speculators who saw an unusually profitable market among African American families whose housing choices were hemmed in by racial segregation and redlining, yet eager to escape substandard rental housing and purchase homes for their families. These contracts offered black buyers the illusion of a mortgage without the protections of a mortgage. Buyers scraped together excessive down payments and made monthly installments at high interest rates toward inflated purchase prices, but never gained ownership – if at all – until the contract was paid in full and all conditions met (Immergluck, 2018; Way, 2010). In the interim, contract sellers reaped all the benefits of holding the deed; they were free to evict the buyers for even minor missed payments as well as to burden the title with liens unrelated to the buyer’s possession (Immergluck, 2018).

Unlike those who enjoyed mortgages, contract buyers accumulated no equity in their homes. Should a buyer want to sell before the contract concluded, they would lose their entire investment. Should they miss even one payment, there were no laws or regulations to protect them against eviction, and the loss of every dollar they invested in their home. “Far from being the marginal economic activity of a few bad apples” (Satter, 2009), contract selling enjoyed the backing of the very banks that turned down black homebuyers and of investment syndicates comprised of white Chicago lawyers, doctors, downtown business leaders, and city government officials, all of whom profited handsomely by unequal housing exploiting market a to separate the and profound disadvantage of black families (McPherson, 1972).

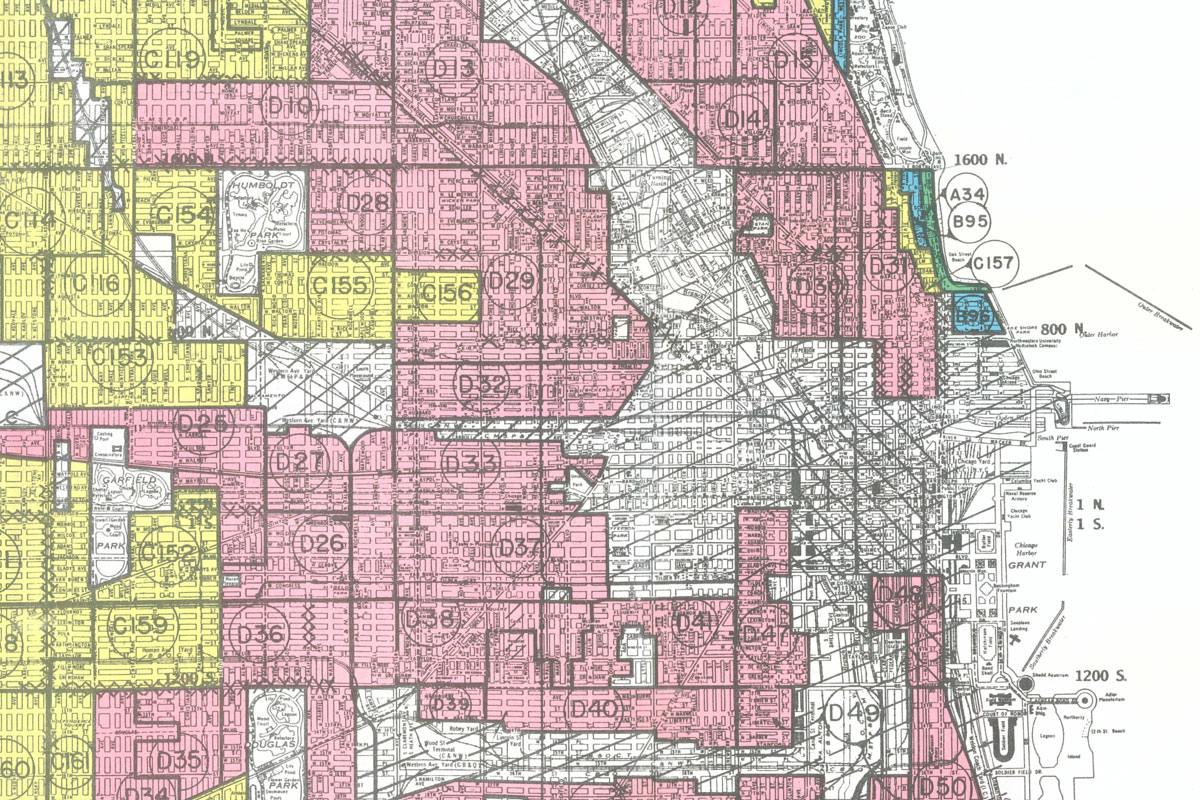

What happened during this crucial era, that of the making of America’s mass white middle class during the long postwar economic boom, was a systematic, legally sanctioned plunder of black wealth. The curse of contract sales still reverberates through Chicago’s black neighborhoods (and their urban counterparts nationwide) and helps explain the vast wealth divide between blacks and whites. Because most of the existing literature concerning land sale contracts in black communities is qualitative, our research team set to undertake a quantitative study, as encompassing as the surviving data allow, to determine the extent of contract selling to black buyers in communities such as Chicago’s West and South Sides and calculate the wealth lost in real dollars as a result of that predatory housing practice.

With a view towards identifying the largest possible universe of land sale contracts entered into by black buyers in Chicago’s South and West Sides during that time, our research team undertook a painstakingly thorough review of land titles at the Cook County Recorder of Deeds and of court records and documents compiled for two federal lawsuits, and now maintained at the National Archives in Chicago. Researchers reviewed over 50,000 documents from those files, reading deposition transcripts and pleadings and examining property records to create a database for analysis.

Key Findings

- Between 75 percent and 95 percent of the homes sold to black families during the 1950s and 60s were sold on contract. On average, the price markup on homes sold on contract was 84 percent.

- We found that African Americans purchasing on contract paid, on average, an additional $587 (in April 2019 dollars) more each month than they would have had they paid the fair price for their home and had a conventional or Federal Housing Authority (FHA) backed mortgage. The average black buyer also paid several points more in interest on their contract loan than the average white buyer paid on a conventional or an FHA backed mortgage.

- Over the two decades studied, the amount of wealth land sales contracts expropriated from Chicago’s black community was between 3.2 and 4.0 billion dollars.